By Jim Malewitz Stateline Staff Writer

Natural gas has been good to Wyoming. The discovery of large shale deposits in the early 2000s put Wyoming at the center of a new energy boom in the West bringing enough jobs to keep unemployment low through the recession and causing tax revenues to skyrocket. Thanks largely to natural gas money Wyoming invested millions of dollars in upgrading roads and schools while socking away more than $1 billion in its rainy day fund.

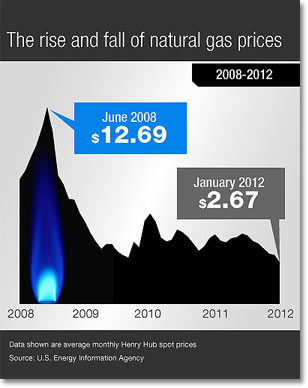

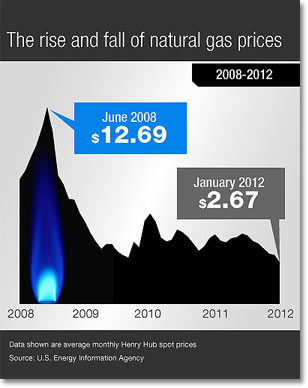

But the boom is over for Wyoming at least for now. A precipitous drop in the price of natural gas has sent state lawmakers scrambling to make budget cuts. For every 75-cent drop in the price of natural gas the state loses about $113 million in expected tax revenue on a budget of just over $3 billion. Over the past two years natural gas prices have fallen by more than $3. Energy experts see the trend lasting for at least another year. Its a very important topic out here" says Renny MacKay spokesman for Matt Mead Wyomings Republican governor.

Other states also have seen their revenues related to natural gas production drop. In Oklahoma the $20 million derived from taxes on natural gas in January came in 16 percent below expectations and 21 percent below last years amount. New Mexico and Texas also are seeing drops in revenues related to natural gas although the pain there as in Oklahoma is compensated by surging oil revenues.

Budgets are only one place where historically low natural gas prices are having an impact in states. The pace of drilling much of it using a controversial practice known as hydraulic fracturing also is being impacted as activity shifts away from some states and toward others. An era of cheap natural gas may also pose a challenge to state efforts to boost wind solar and nuclear power since natural gas is relatively clean burning for a fossil fuel. As a

recent study from the Massachusetts Institute of Technology put it Gas-fired power sets a competitive benchmark against which other technologies must compete in a lower carbon environment."

A vast supply

Multiple forces are colliding to put intense downward pressure on natural gas prices. On the supply side new discoveries of shale deposits along with the advent of horizontal drilling and hydraulic fracturing have unlocked new reserves of natural gas. Some experts predict the U.S. has enough of the fuel to meet energy demands for the next century.

We dont have abundant quantities of natural gas" says Robert Bryce a fellow at the Center for Energy Policy and the Environment at the Manhattan Institute a libertarian think-tank. We have superabundant quantities."

Meanwhile demand for natural gas is down as a result of an unusually mild winter coupled with countrys still-slow economic recovery. The price of natural gas is at its lowest level in ten years.

Consumers of course arent complaining. For some home heating bills have been slashed nearly in half. But energy executives grimace at what low prices mean for their bottom line. The price is almost not sustainable" says Cal Cooper special projects manager at Houston-based Apache Energy.

As a result several companies are scaling back natural gas production. That includes Chesapeake Energy the nations second-largest producer which cited pricing concerns when it

announced plans last month to cut production by about 8 percent and to cut drilling activity in half. Nationwide drilling has fallen 50 percent from its peak in 2008.

While drilling is down in some places however it is up in others. Some energy companies are shifting away from drilling for so-called dry" natural gas in order to increase production of liquid natural gas. This wet" gas contains chemicals such as propane helium and butane which can be sold on their own.

Because of that extra value experts expect drilling will only increase in Ohio home to the mostly wet Utica shale formation. That shift could come at the expense of Pennsylvania whose Marcellus formation yields mostly dry gas within the states borders. Several companies including Chesapeake Energy and Talisman Energy have shifted to wet gas. Talisman

announced this week that it will reduce its Marcellus rigs from 10 to three over the course of the year.

Grid troubles in Texas

An abundance of cheap natural gas also will impact electric generation. In Texas in fact there are worries that it will produce a power shortage. The Electric Reliability Council of Texas has cited the soft market for natural gas as a reason that Texas could face energy shortages by 2014.

As Donna Nelson who chairs the Public Utility Commission of Texas recently explained the situation to state lawmakers low gas prices have led to low prices for wholesale electricity. And that is making utility companies reluctant to build infrastructure that would help Texas meet the electricity demands of its growing population. In Texas utilities bear the cost of such upgrades they dont pass them to consumers. Cheap electricity may be good for consumers Nelson says but it makes it challenging for the electric industry."

Mark Zion executive director of the Texas Public Power Association isnt as grim about Texas energy future. But he says the current market shows the danger of relying too much on one energy resource. Well see a lot of natural gas generation built in the coming years" he told lawmakers. But we need to be careful about putting all our eggs in one basket."

Some environmentalists are fretting that if natural gas stays cheap for long it may become harder to justify investments in renewable energy sources such as solar and wind. Already nuclear energy which not long ago appeared poised for a comeback is feeling the impact. There are several reasons why nuclear developments have stalled but low-price natural gas is one of them. Nuclear" says Bryce is getting priced out of the market."

Concerns in Wyoming

In the meantime some states are looking for their own ways to boost demand for natural gas. Wyomings Mead says investing in natural gas-powered turbines or motor vehicles would be one way to do that. As

Stateline has reported Mead was one of ten governors to sign an agreement to replace aging government vehicles with ones that run on compressed natural gas.

But until natural gas prices rise Mead says the state needs to get tighter on spending. While Wyomings economy remains one of the healthiest among states close to one-third of the states revenue comes from the natural gas industry. So when the price of gas fell about 75 cents from December 2011 to January 2012 Mead had to scramble to find $60 million in cuts to the budget he was about to submit to the legislature. We had to readjust in a hurry" says Renny MacKay Meads spokesperson.

With prices expected to keep falling revenue in Wyoming could fall short of projections again. With that in mind the states Joint Appropriations Committee has called for spending cuts of at least 8 percent and it approved a Mead proposal to set aside $150 million to cover future shortfalls.

We have to be fiscally conservative now" Mead recently told reporters to make sure that we dont put ourselves in a hole down the road."

Contact Jim Malewitz at

jmalewitz@pewtrusts.org

Natural gas has been good to Wyoming. The discovery of large shale deposits in the early 2000s put Wyoming at the center of a new energy boom in the West bringing enough jobs to keep unemployment low through the recession and causing tax revenues to skyrocket. Thanks largely to natural gas money Wyoming invested millions of dollars in upgrading roads and schools while socking away more than $1 billion in its rainy day fund.

But the boom is over for Wyoming at least for now. A precipitous drop in the price of natural gas has sent state lawmakers scrambling to make budget cuts. For every 75-cent drop in the price of natural gas the state loses about $113 million in expected tax revenue on a budget of just over $3 billion. Over the past two years natural gas prices have fallen by more than $3. Energy experts see the trend lasting for at least another year. Its a very important topic out here" says Renny MacKay spokesman for Matt Mead Wyomings Republican governor.

Natural gas has been good to Wyoming. The discovery of large shale deposits in the early 2000s put Wyoming at the center of a new energy boom in the West bringing enough jobs to keep unemployment low through the recession and causing tax revenues to skyrocket. Thanks largely to natural gas money Wyoming invested millions of dollars in upgrading roads and schools while socking away more than $1 billion in its rainy day fund.

But the boom is over for Wyoming at least for now. A precipitous drop in the price of natural gas has sent state lawmakers scrambling to make budget cuts. For every 75-cent drop in the price of natural gas the state loses about $113 million in expected tax revenue on a budget of just over $3 billion. Over the past two years natural gas prices have fallen by more than $3. Energy experts see the trend lasting for at least another year. Its a very important topic out here" says Renny MacKay spokesman for Matt Mead Wyomings Republican governor.

Other states also have seen their revenues related to natural gas production drop. In Oklahoma the $20 million derived from taxes on natural gas in January came in 16 percent below expectations and 21 percent below last years amount. New Mexico and Texas also are seeing drops in revenues related to natural gas although the pain there as in Oklahoma is compensated by surging oil revenues.

Budgets are only one place where historically low natural gas prices are having an impact in states. The pace of drilling much of it using a controversial practice known as hydraulic fracturing also is being impacted as activity shifts away from some states and toward others. An era of cheap natural gas may also pose a challenge to state efforts to boost wind solar and nuclear power since natural gas is relatively clean burning for a fossil fuel. As a recent study from the Massachusetts Institute of Technology put it Gas-fired power sets a competitive benchmark against which other technologies must compete in a lower carbon environment."

A vast supply

Multiple forces are colliding to put intense downward pressure on natural gas prices. On the supply side new discoveries of shale deposits along with the advent of horizontal drilling and hydraulic fracturing have unlocked new reserves of natural gas. Some experts predict the U.S. has enough of the fuel to meet energy demands for the next century.

We dont have abundant quantities of natural gas" says Robert Bryce a fellow at the Center for Energy Policy and the Environment at the Manhattan Institute a libertarian think-tank. We have superabundant quantities."

Meanwhile demand for natural gas is down as a result of an unusually mild winter coupled with countrys still-slow economic recovery. The price of natural gas is at its lowest level in ten years.

Consumers of course arent complaining. For some home heating bills have been slashed nearly in half. But energy executives grimace at what low prices mean for their bottom line. The price is almost not sustainable" says Cal Cooper special projects manager at Houston-based Apache Energy.

As a result several companies are scaling back natural gas production. That includes Chesapeake Energy the nations second-largest producer which cited pricing concerns when it announced plans last month to cut production by about 8 percent and to cut drilling activity in half. Nationwide drilling has fallen 50 percent from its peak in 2008.

While drilling is down in some places however it is up in others. Some energy companies are shifting away from drilling for so-called dry" natural gas in order to increase production of liquid natural gas. This wet" gas contains chemicals such as propane helium and butane which can be sold on their own.

Because of that extra value experts expect drilling will only increase in Ohio home to the mostly wet Utica shale formation. That shift could come at the expense of Pennsylvania whose Marcellus formation yields mostly dry gas within the states borders. Several companies including Chesapeake Energy and Talisman Energy have shifted to wet gas. Talisman announced this week that it will reduce its Marcellus rigs from 10 to three over the course of the year.

Grid troubles in Texas

An abundance of cheap natural gas also will impact electric generation. In Texas in fact there are worries that it will produce a power shortage. The Electric Reliability Council of Texas has cited the soft market for natural gas as a reason that Texas could face energy shortages by 2014.

As Donna Nelson who chairs the Public Utility Commission of Texas recently explained the situation to state lawmakers low gas prices have led to low prices for wholesale electricity. And that is making utility companies reluctant to build infrastructure that would help Texas meet the electricity demands of its growing population. In Texas utilities bear the cost of such upgrades they dont pass them to consumers. Cheap electricity may be good for consumers Nelson says but it makes it challenging for the electric industry."

Mark Zion executive director of the Texas Public Power Association isnt as grim about Texas energy future. But he says the current market shows the danger of relying too much on one energy resource. Well see a lot of natural gas generation built in the coming years" he told lawmakers. But we need to be careful about putting all our eggs in one basket."

Some environmentalists are fretting that if natural gas stays cheap for long it may become harder to justify investments in renewable energy sources such as solar and wind. Already nuclear energy which not long ago appeared poised for a comeback is feeling the impact. There are several reasons why nuclear developments have stalled but low-price natural gas is one of them. Nuclear" says Bryce is getting priced out of the market."

Concerns in Wyoming

In the meantime some states are looking for their own ways to boost demand for natural gas. Wyomings Mead says investing in natural gas-powered turbines or motor vehicles would be one way to do that. As Stateline has reported Mead was one of ten governors to sign an agreement to replace aging government vehicles with ones that run on compressed natural gas.

But until natural gas prices rise Mead says the state needs to get tighter on spending. While Wyomings economy remains one of the healthiest among states close to one-third of the states revenue comes from the natural gas industry. So when the price of gas fell about 75 cents from December 2011 to January 2012 Mead had to scramble to find $60 million in cuts to the budget he was about to submit to the legislature. We had to readjust in a hurry" says Renny MacKay Meads spokesperson.

With prices expected to keep falling revenue in Wyoming could fall short of projections again. With that in mind the states Joint Appropriations Committee has called for spending cuts of at least 8 percent and it approved a Mead proposal to set aside $150 million to cover future shortfalls.

We have to be fiscally conservative now" Mead recently told reporters to make sure that we dont put ourselves in a hole down the road."

Contact Jim Malewitz at jmalewitz@pewtrusts.org

Other states also have seen their revenues related to natural gas production drop. In Oklahoma the $20 million derived from taxes on natural gas in January came in 16 percent below expectations and 21 percent below last years amount. New Mexico and Texas also are seeing drops in revenues related to natural gas although the pain there as in Oklahoma is compensated by surging oil revenues.

Budgets are only one place where historically low natural gas prices are having an impact in states. The pace of drilling much of it using a controversial practice known as hydraulic fracturing also is being impacted as activity shifts away from some states and toward others. An era of cheap natural gas may also pose a challenge to state efforts to boost wind solar and nuclear power since natural gas is relatively clean burning for a fossil fuel. As a recent study from the Massachusetts Institute of Technology put it Gas-fired power sets a competitive benchmark against which other technologies must compete in a lower carbon environment."

A vast supply

Multiple forces are colliding to put intense downward pressure on natural gas prices. On the supply side new discoveries of shale deposits along with the advent of horizontal drilling and hydraulic fracturing have unlocked new reserves of natural gas. Some experts predict the U.S. has enough of the fuel to meet energy demands for the next century.

We dont have abundant quantities of natural gas" says Robert Bryce a fellow at the Center for Energy Policy and the Environment at the Manhattan Institute a libertarian think-tank. We have superabundant quantities."

Meanwhile demand for natural gas is down as a result of an unusually mild winter coupled with countrys still-slow economic recovery. The price of natural gas is at its lowest level in ten years.

Consumers of course arent complaining. For some home heating bills have been slashed nearly in half. But energy executives grimace at what low prices mean for their bottom line. The price is almost not sustainable" says Cal Cooper special projects manager at Houston-based Apache Energy.

As a result several companies are scaling back natural gas production. That includes Chesapeake Energy the nations second-largest producer which cited pricing concerns when it announced plans last month to cut production by about 8 percent and to cut drilling activity in half. Nationwide drilling has fallen 50 percent from its peak in 2008.

While drilling is down in some places however it is up in others. Some energy companies are shifting away from drilling for so-called dry" natural gas in order to increase production of liquid natural gas. This wet" gas contains chemicals such as propane helium and butane which can be sold on their own.

Because of that extra value experts expect drilling will only increase in Ohio home to the mostly wet Utica shale formation. That shift could come at the expense of Pennsylvania whose Marcellus formation yields mostly dry gas within the states borders. Several companies including Chesapeake Energy and Talisman Energy have shifted to wet gas. Talisman announced this week that it will reduce its Marcellus rigs from 10 to three over the course of the year.

Grid troubles in Texas

An abundance of cheap natural gas also will impact electric generation. In Texas in fact there are worries that it will produce a power shortage. The Electric Reliability Council of Texas has cited the soft market for natural gas as a reason that Texas could face energy shortages by 2014.

As Donna Nelson who chairs the Public Utility Commission of Texas recently explained the situation to state lawmakers low gas prices have led to low prices for wholesale electricity. And that is making utility companies reluctant to build infrastructure that would help Texas meet the electricity demands of its growing population. In Texas utilities bear the cost of such upgrades they dont pass them to consumers. Cheap electricity may be good for consumers Nelson says but it makes it challenging for the electric industry."

Mark Zion executive director of the Texas Public Power Association isnt as grim about Texas energy future. But he says the current market shows the danger of relying too much on one energy resource. Well see a lot of natural gas generation built in the coming years" he told lawmakers. But we need to be careful about putting all our eggs in one basket."

Some environmentalists are fretting that if natural gas stays cheap for long it may become harder to justify investments in renewable energy sources such as solar and wind. Already nuclear energy which not long ago appeared poised for a comeback is feeling the impact. There are several reasons why nuclear developments have stalled but low-price natural gas is one of them. Nuclear" says Bryce is getting priced out of the market."

Concerns in Wyoming

In the meantime some states are looking for their own ways to boost demand for natural gas. Wyomings Mead says investing in natural gas-powered turbines or motor vehicles would be one way to do that. As Stateline has reported Mead was one of ten governors to sign an agreement to replace aging government vehicles with ones that run on compressed natural gas.

But until natural gas prices rise Mead says the state needs to get tighter on spending. While Wyomings economy remains one of the healthiest among states close to one-third of the states revenue comes from the natural gas industry. So when the price of gas fell about 75 cents from December 2011 to January 2012 Mead had to scramble to find $60 million in cuts to the budget he was about to submit to the legislature. We had to readjust in a hurry" says Renny MacKay Meads spokesperson.

With prices expected to keep falling revenue in Wyoming could fall short of projections again. With that in mind the states Joint Appropriations Committee has called for spending cuts of at least 8 percent and it approved a Mead proposal to set aside $150 million to cover future shortfalls.

We have to be fiscally conservative now" Mead recently told reporters to make sure that we dont put ourselves in a hole down the road."

Contact Jim Malewitz at jmalewitz@pewtrusts.org