At more than 24.5%, average rate for new credit cards is higher than ever

WASHINGTON, D.C. (Texas Insider Report) — “Credit card balances experienced a large jump in the 3rd Quarter,” said Economic Research Advisor Donghoon Lee of the Federal Reserve Bank of New York, as the bank released its most new report showing Credit Card Balances have spiked by $154 billion over the past year – the largest increase seen since 1999 according to the bank's records.

Perhaps even more concerning for the economy as the Christmas Holiday Shopping Season moves into full swing, is the fact that Credit Card Delinquency Rates also rose across the board according to the Fed Report – especially among millennial borrowers between the ages of 30 and 39.

Yes, Americans now owe a record total of $1.08 trillion dollars on their credit cards, says the latest report on household debt from the Federal Reserve Bank of New York.

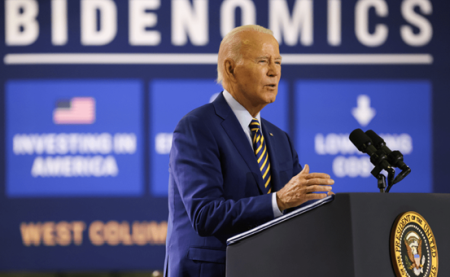

Yes, Americans now owe a record total of $1.08 trillion dollars on their credit cards, says the latest report on household debt from the Federal Reserve Bank of New York.With most American consumers already being burdened by the continued cost & price hikes of "Bidenomics" – particularly for food, gas and housing – the report also revealed that more credit cardholders are now carrying debt forward from month to month... or falling behind on payments.

As a result, a greater percentage of balances are now going beyond 180 days delinquent, according to a separate report from the Consumer Financial Protection Bureau.

Nearly one-tenth of credit card users find themselves in “Persistent Debt” – where they are charged more in Interest & Fees each year than they pay toward their original purchases – a pattern that's now become increasingly difficult to break, the consumer watchdog said.

Credit Card Rates Top 24% in Interest

Credit card rates were already high, but have spiked dramatically and reached an all-time high this year as the result of the Federal Reserve’s string of 11 rate hikes, including four in 2023.

Since most credit cards have a variable rate, there’s a direct connection between what consumers are charged on their credit card debt and what the Federal Reserve Banks set as their benchmark interest rate – known as the "Federal Funds Rate." As the bank's benchmark rates rose, credit card rates followed suit.

While many Americans benefited from a few government-supplied safety nets put in place during the COVID-19 Pandemic – which enabled some cardholders to keep their credit card debt balances low or in check – those cash reserves are largely gone after consumers gradually spent down what they preceived to be excess savings.

Now, “consumers are maintaining and supporting their lifestyles using credit card debt,” said Howard Dvorkin, a certified public accountant and the chairman of Debt.com.

Now, “consumers are maintaining and supporting their lifestyles using credit card debt,” said Howard Dvorkin, a certified public accountant and the chairman of Debt.com.

At more than 24.5% today, the average Annual Percentage Rate (APR) for a brand-new credit card was higher than ever starting in mid-August of this year, according to CreditCards.com’s Weekly Rate Report.

Mortgage Rates for home purchases are also now sitting at their highest levels in more than 20 years, keeping would-be buyers locked out of the housing market – and forcing would-be sellers to stay put.