Here in Texas, Lone Star families deserve assurance and financial stability in times unforeseen events

By State Rep. Dennis Paul

AUSTIN, Texas (Texas Insider Report) — Millions of families in Texas and across the nation invest in insurance to navigate unforeseen life events. When policyholders fulfill their financial commitments through premiums, they do so with the expectation that insurers will honor their commitment to settle claims when needed.

This trust is only possible if regulatory bodies prioritize consumer welfare by formulating rules that safeguard policyholders and maintain the accessibility and affordability of insurance – especially during vulnerable moments.

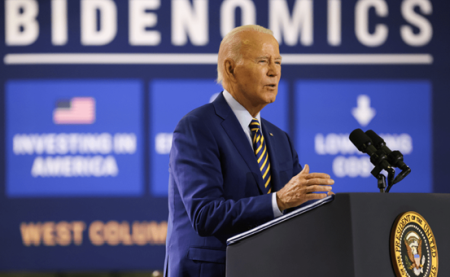

Regrettably, unelected bureaucrats and the Biden White House are now jeopardizing these vital insurance plans with proposed rules and penalties that would disproportionately impact retirees and families. This threat stems from the affiliation of these plans with private investments. Imposing new penalties on Life Insurance Plans would particularly harm individuals relying on such coverage during times of tragedy.

Regrettably, unelected bureaucrats and the Biden White House are now jeopardizing these vital insurance plans with proposed rules and penalties that would disproportionately impact retirees and families. This threat stems from the affiliation of these plans with private investments. Imposing new penalties on Life Insurance Plans would particularly harm individuals relying on such coverage during times of tragedy.Here in Texas, our Lone Star families deserve assurance and financial stability in times unforeseen events. We uphold our expectations and autonomy, resisting external interference in our affairs.

As a member of the Texas House Insurance Committee, I have ardently advocated for fair regulations that foster competition among insurers while ensuring consumers receive the promised coverage. During the 86th Texas Legislative Session, I supported House Bill 3306 which amended the state's Insurance Code to mandate certain insurers to disclose their corporate governance annually.

A functional insurance system empowers accountable state officials to tailor policies to the needs of their constituents, exemplified in Texas. Unfortunately, the National Association of Insurance Commissioners (NAIC) now routinely outsources insurance rulemaking to its staff, raising concerns.

This not-for-profit association – despite its purported aim to support state insurance commissioners – lacks direct accountability to policyholders, voters, or Elected Officials.

As a member of the Texas House Insurance Committee, I have ardently advocated for fair regulations that foster competition among insurers while ensuring consumers receive the promised coverage. During the 86th Texas Legislative Session, I supported House Bill 3306 which amended the state's Insurance Code to mandate certain insurers to disclose their corporate governance annually.

A functional insurance system empowers accountable state officials to tailor policies to the needs of their constituents, exemplified in Texas. Unfortunately, the National Association of Insurance Commissioners (NAIC) now routinely outsources insurance rulemaking to its staff, raising concerns.

This not-for-profit association – despite its purported aim to support state insurance commissioners – lacks direct accountability to policyholders, voters, or Elected Officials.

The NAIC has been advocating for uniform rules that may not align with the unique needs of Texas and other states. For instance, the Securities Valuation Office (SVO) within the NAIC is tasked with reviewing insurance company investments, creating a potential conflict of interest and hindering the reliance on regulated credit rating agencies.

It's evident that NAIC staff's actions stifle innovation and flexibility in the insurance market. They push for rules that could impact all insurers nationwide based on the actions of a few, hindering the industry's ability to embrace emerging asset classes.

This trend needs to stop.

This trend needs to stop.

This trend needs to stop.

This trend needs to stop.NAIC staff's attempts to influence rules across states – and challenge investment ratings – demand scrutiny. These intricate issues, often overlooked by consumers, must be addressed to ensure fair practices in the insurance sector.

As a state legislator, my duty is to safeguard consumers, emphasizing that the state-centric approach to insurance regulation is effective only when states retain control.

Its crucial for the public to recognize that decisions regarding state insurance policies, especially in Texas, resonate nationally. These decisions impact crucial markets and hardworking families.

Consequently, such weighty matters should not be delegated to out-of-state groups.

The time has come for more individuals to denounce this frequently overlooked injustice and reclaim authority where it rightfully belongs – with elected and appointed insurance commissioners who prioritize policyholder interests.

I place my trust in State Insurance Commissioners – including those in Texas – to act responsibly, unlike NAIC executives in Washington, D.C.

State Representative Dennis Paul (R-Houston) was first elected to the Texas House of Representatives in 2014 and is in his 4th term representing House District 129. He currently serves as a member of the Texas House Insurance Committee, and previously served eight years on the Republican Party of Texas' State Republican Executive Committee (SREC,) where he chaired the Rules Committee for the organization.

State Representative Dennis Paul (R-Houston) was first elected to the Texas House of Representatives in 2014 and is in his 4th term representing House District 129. He currently serves as a member of the Texas House Insurance Committee, and previously served eight years on the Republican Party of Texas' State Republican Executive Committee (SREC,) where he chaired the Rules Committee for the organization.