Democrats, IRS face uproar as Special Agent job posting requires ability to 'carry a firearm' and 'use deadly force, if necessary.'

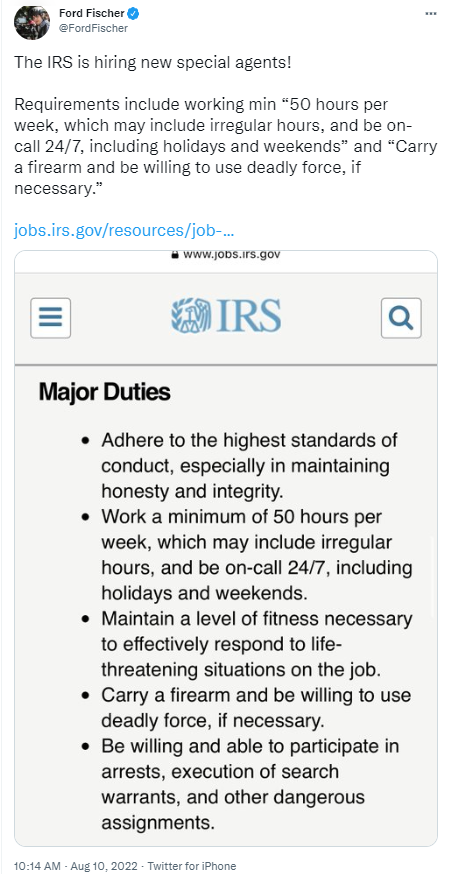

WASHINGTON, D.C. (Texas Insider Report) — A contoversial Internal Revenue Service (IRS) job posting for "Criminal Investigation Special Agents" within the the agency's Law Enforcement Branch drew quick and heated criticism Wednesday after the position's job description was discovered to include language listing as a "key requirement" being "legally allowed to carry a firearm," since "major duties" listed include being able to "Carry a firearm and be willing to use deadly force, if necessary" – as well as to "Be willing and able to participate in arrests, execution of search warrants, and other dangerous assignments."

The uproar over the IRS's use of "deadly force" came as Republican's increased their criticisms over spending $80 billion during a recession to hire approximately 87,000 IRS Agents – which would more than double the IRS's total current workforce over a 10-year period – with more than half of the additional agents hired to help the agency crack down on tax evasion.

The uproar over the IRS's use of "deadly force" came as Republican's increased their criticisms over spending $80 billion during a recession to hire approximately 87,000 IRS Agents – which would more than double the IRS's total current workforce over a 10-year period – with more than half of the additional agents hired to help the agency crack down on tax evasion.It also comes just days ahead of Friday's scheduled vote in the U.S. House of Representatives on the so-called "Inflation Reduction Act" – of which Democrat-Socialist Sen. Bernie Sanders said during Senate Floor debate:

"I want to take a moment to say a few words about the so-called 'Inflation Reduction Act.'

"And I say so-called, by the way, because according to the CBO (Congressional Budget Office,) and other economic organizations who have studied this bill, it will, in fact, have a minimal impact on inflation," said Sanders.

"And I say so-called, by the way, because according to the CBO (Congressional Budget Office,) and other economic organizations who have studied this bill, it will, in fact, have a minimal impact on inflation," said Sanders.

Republicans warn that the Democrat's bill funds an army of IRS Agents to conduct more than 1.2 million additional annual audits on Americans' tax returns, cracking down particularly on small business owners and lower-income workers who earn less than $75,000 per year.

"There is language in this bill that provides some guidelines, but it's not at all a guarantee," said William McBride, Vice President of Gederal Tax & Economic Policy at the non-partisan Tax Foundation.

"It indicates that the intent of the increased spending is not to target those earning less than $400,000, but 'intent' is a somewhat squishy word."

"The fact of the matter is, most returns report income under $100,000. That's where the money is, so to speak," said McBride.

"It indicates that the intent of the increased spending is not to target those earning less than $400,000, but 'intent' is a somewhat squishy word."

"The fact of the matter is, most returns report income under $100,000. That's where the money is, so to speak," said McBride.

- LISTEN HERE: Inflation Reduction Act Will 'Crush' Those Living Paycheck-to-Paycheck

- Texas Cong. Kevin Brady reacts to Monday's FBI raid, and the "Inflation Reduction Act" passing through Congress

- Increasing IRS Funding,

- Creating a 15% Minimum Corporate Tax,

- Allowing Medicare to negotiate prescription drug costs, and

- Closing a popular tax loophole used to carry interest expenses forward to future tax years for deduction.

It while roughly $300 billion of the new revenue raised would go toward paying down the nation's deficit.

According to an analysis released by House Republicans, small business owners and lower-income working Americans are slated to receive 60% of the additional tax audits.

The analysis, which is a conservative estimate based upon recent IRS audit rates and tax filings data, shows that:

- Individuals with an annual income of $75,000 or less would be subject to 710,863 additional IRS audits, while

- Those making over $1 million in annual income would receive 52,295 more audits under the bill.

- Another 236,685 of the estimated additional audits would target individuals with an annual income between $75,000 and $200,000.

- READ MORE: Middle-Class Americans to Bear Brunt of IRS Audits Under Dem Inflation Bill, Analysis Shows

- Americans making less than $75,000 will be subject to 710,863 additional audits, says analysis

The Democrats' inflation bill also includes a provision from President Biden's original "Build Back Better Act" budget proposal that Sen. Joe Manchin stopped during the bill's previous negotiations, which he ultimately killed over concerns that the bill would dampen economic growth and worsen inflation.

The Democrats' inflation bill also includes a provision from President Biden's original "Build Back Better Act" budget proposal that Sen. Joe Manchin stopped during the bill's previous negotiations, which he ultimately killed over concerns that the bill would dampen economic growth and worsen inflation.But, the "Inflation Reduction Act" passed last week by Senate included the same 15% Minimum Corporate Tax included Biden's "Build Back Better" plan.

"The proposed 15% minimum tax on corporate income is the most economically damaging provision in the bill," said the non-partisan Tax Foundation's analysis of the bill in December.

A separate analyses by the Penn Wharton Budget Model and National Taxpayers Union Foundation also concluded – as did Senator Bernie Sanders – that the "Inflation Reduction Act" would not reduce inflation.

In addition, the Joint Committee on Taxation (JCT) published a report Friday that showed most Americans, including those that make less than $10,000, would face increased costs as a result of the bill.

Republicans, including Senate Finance Committee ranking member Mike Crapo, R-Idaho, highlighted the report and slammed Democrats for pushing a bill that "raises taxes on the middle class."

Democrats argued the JCT analysis was incomplete, and didn't factor in the bill's energy, pharmaceutical and health care cost reductions.

Senate Democrats projected that enhancing IRS funding could add an extra $124 billion in federal revenue over the next decade by hiring more tax enforcers who can crack down on rich individuals and corporations attempting to evade taxes.

"They'll need to increase the audit rates on middle-class and low-income folks to get the sort of revenues they're claiming from this," McBride said.

"People who don't have the resources get a letter in the mail from the IRS threatening them – what are they going to do?

"People who don't have the resources get a letter in the mail from the IRS threatening them – what are they going to do?"It might be an increase of a few bucks, a few hundred bucks that the IRS is requesting – and rather than go out and try to get a lawyer to fight it, they generally pay it," McBride said.

In response to the criticism about the expected uptick in tax audits under the bill, IRS Commissioner Charles Rettig said that "audit rates" will not increase relative to recent years.

Democrats in the Senate passed the legislation last Sunday on a purely partisan vote, with Vice President Kamala Harris casting the key tie-breaking vote to overcome the bill's initial 50-50 partisan split.