88% of Americans say its the Economy, and 85% say its Inflation that will be most important factor for them to determine which candidate to support in November

WASHINGTON, D.C. (Texas Insider Report) — Employers hired just 175,000 workers last month, falling far short of Wall Street economist's expectations of 240,000 jobs, just released U.S. Bureau of Labor Statistics data shows – as the nation's Unemployment Rate also increased in April to 3.9%.

While the latest jobs and unemployment figures revealed a worse-than-expected level of growth in the nation's jobs, it and a growing list of other factors also offer what many economists believe is evidence of an economic slowdown that threatens to downshift the nation’s anemic level of economic growth.

The slowdown in the jobs market and the increase in unemployment matches a similar trend in another major measure of economic health: Gross Domestic Product.

The slowdown in the jobs market and the increase in unemployment matches a similar trend in another major measure of economic health: Gross Domestic Product.

The most recent GDP Report from the Commerce Department said that Gross Domestic Product – the economy’s total output of goods and services – decelerated in the January-March quarter.

- READ MORE: U.S. Growth Slowed Sharply Last Quarter to a 1.6% Pace

- The nation’s economy slowed sharply last quarter to a 1.6% annual pace in the face of high interest rates, says the latest U.S. Commerce Department figures for Gross Domestic Product.

“Today’s weaker (jobs) numbers need to mark the start of a new, slower trend for interest rate cuts to be back on the agenda in a serious way,” said Seema Shah, chief global strategist at Principal Asset Management, noting, "but by then the new fear could be a slowing economy."

In other words, American consumers may need to get used to continued and ongoing price inflation for the remainder of 2024.

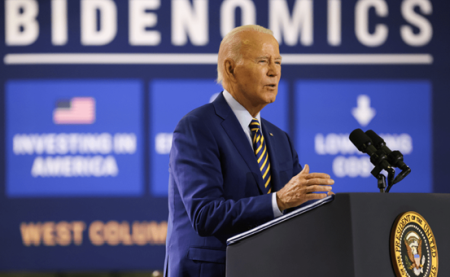

The state of the U.S. economy has been first and formost on American voter's minds, as the 2024 Presidential Election Season has intensified – and Americans increasingly hold dim views of Biden’s handling of the economy and inflation.

Overall, the economy and inflation are the most important issues for Americans in determining who they will support for president in November. And, for months more Americans have said they trust former-President Trump on these issues than current President Joe Biden.

- The economy (88%) and inflation (85%) are the issues that Americans say will be most important for them in determining which candidate they will support in November.

- 44% of Americans say the economy, and 45% say inflation are one of the single most important issues for them.

- 46% of Americans say they trust Mr. Trump to handle the economy and inflation, compared to just

- 32% who say they trust Mr. Biden on the economy.

As U.S. output slowed dramatically at the outset of 2024 – and contrary to media narratives for optimism during an Election Year – the jobs reports reflect a series of underlying and ongoing trends:

- Full-time jobs are declining,

- while Part-Time jobs are increasing.

- Over the past year, part-time jobs have surged by 1 million,

- while full-time positions dropped by over 500,000.

- AND, the gap between total jobs and the number of Americans employed has widened,

- indicating potential inaccuracies in President Biden's continued efforts to paint a positive picture for the country's economic assessment.

The persistent rise in part-time work suggests economic weakness, possibly leading to a recession, despite some analysts' hopes for a “soft landing.”

The slowdown has followed a prolonged period of high interest rates – and also coincides with a months-long stretch of lingering inflation.

Since last July, the Federal Reserve's bell-weather Fed Funds Rate has remained between 5.25% and 5.5%, matching its highest level in more than two decades.

The Fed also decided to hold its benchmark interest rate steady for the 6th consecutive time at its meeting last Wednesday, citing a lack of progress in slowing the rate of inflation that's hampering middle-to-lower families budgets with gas and grocery price increases.

The index measures both Americans’ assessment of current economic conditions, and their outlook for the next six months.

It also reflects the prevailing business conditions, and likely developments for the months ahead based upon:

It also reflects the prevailing business conditions, and likely developments for the months ahead based upon:- Consumer Attitudes,

- their Buying Intentions,

- Vacation Plans, and

- Consumer expectations for Inflation & Interest Rates.

A reading under 80 can signal a potential recession in the near future.

Overall confidence declined among consumers of all age groups and all income groups – with the exception of those earning annual salaries between $25,000 and $49,999.

The number of respondents who said they planned to buy a home or big-ticket appliance also declined, as did the number of those who said they plan to take a vacation.